One of the main reasons for EPFO rejecting the EPF withdrawal claim is incomplete KYC. Therefore, to avoid rejection by the EPFO, it is important to ensure that your EPF account is KYC compliant, before making any request.

It is important that your Employees’ Provident Fund (EPF) account is KYC compliant. If the EPF account is not KYC compliant, then you will not be able to avail various services online on the Employees Provident Fund Organisation’s (EPFO) Member e-Sewa Portal. Some of these services include filing withdrawal claim, transfer of account, making nomination etc.

If your EPF account is not KYC compliant, then the EPFO can reject the service request raised by you and ask you to first make your account KYC compliant.

Here’s how you can check and complete the KYC process for your EPF account.

Checking KYC compliance in EPF account

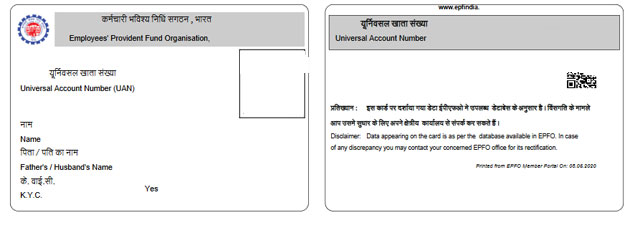

There are three ways to check if your EPF account is KYC compliant. The first way is by checking your UAN card. UAN stands for Universal Account Number.

A. KYC Status via UAN card

Step 1: Log in to your account on the Member e-Sewa Portal.

Step 2: Select ‘UAN card’ tab under the ‘View’ tab.

If the KYC in your EPF account is completed, then the UAN card will show ‘Yes’ in front of KYC information row.

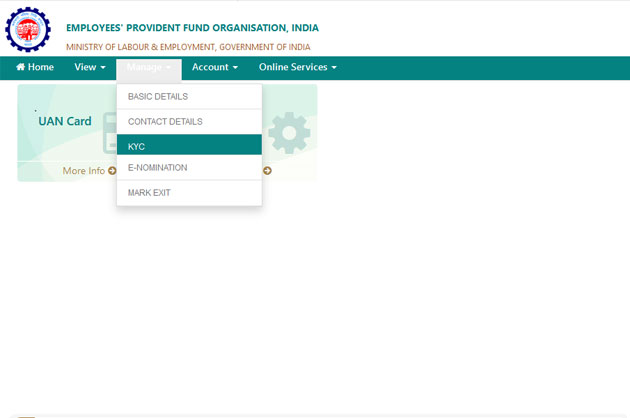

B. Documents that are approved under KYC tab

Another way to check if your EPF account is KYC compliant is by checking the documents that are approved and verified in the EPFO records. This can be checked in the ‘KYC’ option under the ‘Manage’ tab on the Member e-Sewa Portal. The EPF account holder can check the documents under the ‘Digitally Approved KYC’ tab.

The tab will show the list of documents that are approved and verified. For instance, for any online claim submission Aadhaar is mandatory. Therefore, one must ensure that Aadhaar is mentioned and verified in the list of documents. Similarly, bank account and IFSC details shown in the documents must be correct for timely credit of the EPF funds.

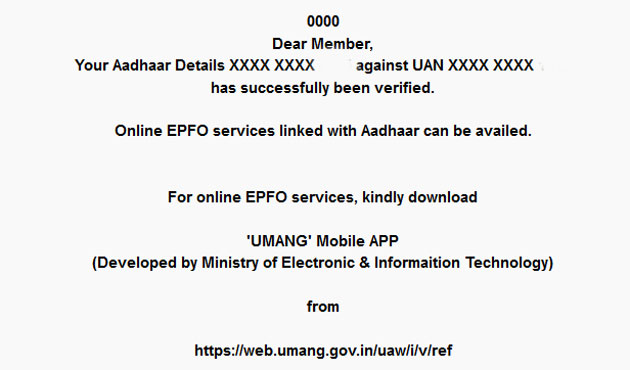

C. By checking on EPF India website

The third way to check if EPF account is KYC compliant is by visiting this website: https://iwu.epfindia.gov.in/eKYC/. Here, click on ‘Track EKYC’ option. After this, you will be asked to enter your UAN and captcha code.

If your account is KYC compliant, then the following message will appear on your computer screen: “Dear Member, Your Aadhaar Details XXXX XXXX against UAN XXXX XXXX has successfully been verified. Online EPFO services linked with Aadhaar can be availed.”

However, if the KYC is not completed in your EPF account, then you will have to complete the KYC process.

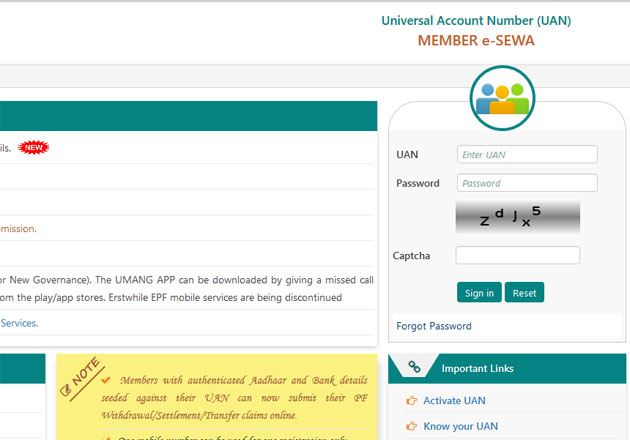

How to complete the KYC process

Step 1: Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Select ‘KYC’ option under the ‘Manage’ tab.

Step 3: Select the documents that you are going to upload. Do keep in mind that it is mandatory to link to your Aadhaar to UAN to be eligible for online claim submission. Similarly, PAN is also mandatory if the number of service years is less than five years at the time withdrawing the funds. Also, your bank account with correct IFSC must be linked to your UAN for the timely credit of EPF withdrawal.

Step 4: Enter the document number, name as per document and other details (see image) in the respective fields. For instance, after selecting document type ‘bank’, you will be required to enter your savings bank account number in the document number area, name as per the bank records in the name as per document filed and IFSC in other field.

Similar steps have to be taken in case of PAN and Aadhaar. The documents required to be uploaded will depend on what is missing from the documents required i.e. Aadhaar, PAN or bank account details etc.

The EPFO portal allows the following documents to be uploaded as proof for the purpose of KYC:

a) Bank

b) PAN

c) Aadhaar

d) Passport

e) Driving License

f) Election Card

g) Ration card

h) National population register.

Step 5: Once the documents of your choice are uploaded on the EPFO portal, click on save.

The status of your KYC will be shown under the ‘KYC Pending for Approval’ tab. Remember you will be required to submit the document proof to your employer. The EPFO will update your KYC details in your account only after your employer has verified your documents.

As per the FAQs mentioned on EPF website, the system will also trigger SMS on the individual’s registered mobile number once the KYC update is appoved by an employer.

One your KYC is approved, the status of the documents that were uploaded and submitted by you to your employer will be shown in the ‘Digital Approved KYC’ section under the KYC option. The documents will be shown as ‘approved by establishment’ and ‘online verification status’.

In case your employer is not appoving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organisation. If no one is responding to your request you can approach EPF grievance via http://www.epfigms.gov.in/ as per the FAQs.

Need Information or Confused about Something ?

Ask a QuestionDid You Know : Top 15 Free Online Learning Platforms

-

Free Online Education Degrees : Coursera:

Coursera partners with universities and organizations worldwide to offer a wide range of courses. While many courses are free, a fee is often required for certification.

-

Free Online Education Degrees: edX:

Founded by MIT and Harvard, edX offers high-quality courses from top universities and institutions around the world. Certificates are available for a fee.

-

Free Online Education Degrees : Khan Academy:

Khan Academy provides free educational content in various subjects, especially mathematics and science, using instructional videos and practice exercises.

-

Free Online Education Degrees : Udacity:

Udacity focuses on tech-related courses and nanodegree programs, offering free content as well as more in-depth paid programs.

-

Free Online Education Degrees : MIT OpenCourseWare (OCW):

MIT OCW provides a vast array of MIT's course content for free, covering a wide range of disciplines.

-

Free Online Education Degrees : Harvard Extension School:

Harvard Extension School offers a selection of free online courses. While some courses are free, others may require payment for a certificate.

-

Free Online Education Degrees: Stanford Online:

Stanford Online offers a variety of free courses in different disciplines, including computer science, engineering, and business.

-

Best Free Online Courses : Carnegie Mellon Open Learning Initiative (OLI):

OLI offers free online courses and resources designed to improve learning outcomes through research-based methodologies.

-

Best Free Online Courses : FutureLearn:

FutureLearn partners with universities and institutions to offer a diverse range of free online courses. Certificates are available for a fee.

-

Best Free Online Courses: Alison:

Alison offers a wide range of free online courses, including diploma and certificate programs, covering various subjects.

-

Best Free Online Courses: Open Yale Courses:

Yale University provides free access to a selection of introductory courses through Open Yale Courses.

-

Best Free Online Courses : UC Berkeley Online:

UC Berkeley offers free online courses on a variety of subjects, ranging from computer science to humanities.

-

Best Free Online Courses : Google Digital Garage:

Google Digital Garage provides free courses on digital skills, including online marketing, data analysis, and more.

-

Best Free Online Courses : Codecademy:

Codecademy offers free coding courses, interactive exercises, and coding projects to help individuals learn programming languages.

-

Best Free Online Courses : LinkedIn Learning (formerly Lynda.com):

LinkedIn Learning provides a variety of video courses on professional development, technology, and creative skills. It offers a free trial period.